This paper aims at analysing, from a legal perspective, the context and meaning of the inclusion of nuclear energy and natural gas within the European Union climate taxonomy. This is the first section of a two-part analysis. The second section, which may be found here, focuses more specifically on the inclusion of nuclear power and fossil gas within the taxonomy.

The regulation describing the list of activities that are considered helpful to fight against the human impact on the environment has been named the “EU Taxonomy of environmentally sustainable economic activities” (hereinafter the “EU Taxonomy”).

The European Commission anticipated the criticism on its complementary climate delegated regulation (the “Complementary Regulation”) which includes – although for a transitional period – nuclear power and fossil gas within the EU Taxonomy:

Context: the European Union movement towards sustainable investments

Purpose. The Regulation 2020/852 of 18 June 2020 on the establishment of a framework to facilitate sustainable investment (hereinafter the “Taxonomy Regulation”) aims at directing investments toward truly sustainable activities, avoiding investors to fall for greenwashing projects.

According to point 3 of its preamble, the Taxonomy Regulation is key to comply with the 2050 objective of a carbon-neutral European Union.

Scope. With this purpose in mind, the Taxonomy Regulation provides criteria for the identification of environmentally sustainable activities.

This is mainly aimed at the transparency of financial products and corporate bonds – which may only be claimed sustainable if they comply with these criteria – and the activity of some major undertaking. An extension to State bonds is also expected following the European Commission proposal for a regulation on European green bonds on 6 July 2021 which is aligned with the EU Taxonomy and proposes a EU green bonds standard (EUGBS).

The enforcement of the EU Taxonomy technical screening criteria has even been anticipated to the extent possible in the implementation of the Next Generation EU (NGEU) post-COVID deal of €750 billion adopted in July 2020 by the Member States. At least 37% of this amount shall indeed be directed toward climate protection, in activities allowing for a green European transition, and duly demonstrated within the Member States’ Recovery and Resilience Plans.

Constraints. No sanction is applied to investments in activities that are not sustainable as these are not prohibited. However, such activities may not benefit from environmentally sustainable financial products and corporate bonds; the same should apply to State aids financed by EU or Member States green bonds.

Are conversely subject to “effective, proportionate and dissuasive” sanctions, the provision of false information on the environmentally sustainable qualification of financial products and corporate bonds.

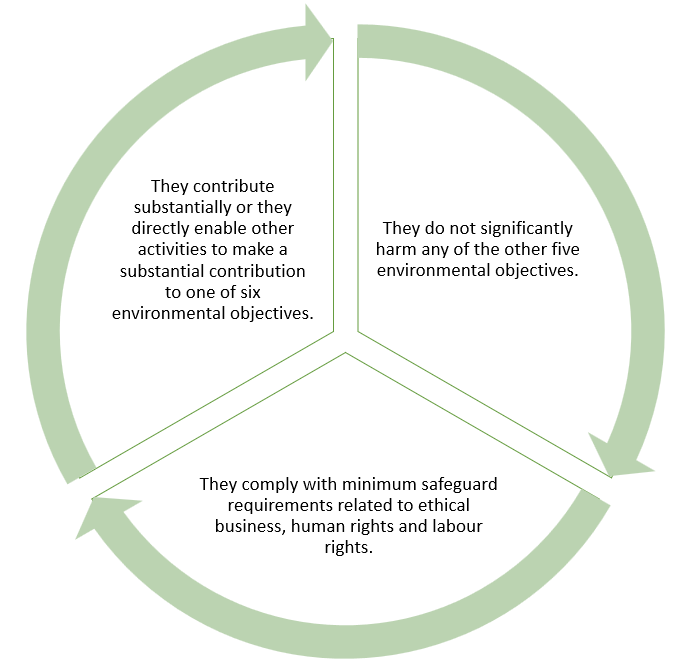

Definition of activities deemed sustainable. The Taxonomy Regulation provides for three set of criteria to identify activities deemed environmentally sustainable (in accordance with the corresponding technical screening criteria implemented by the European Commission) :

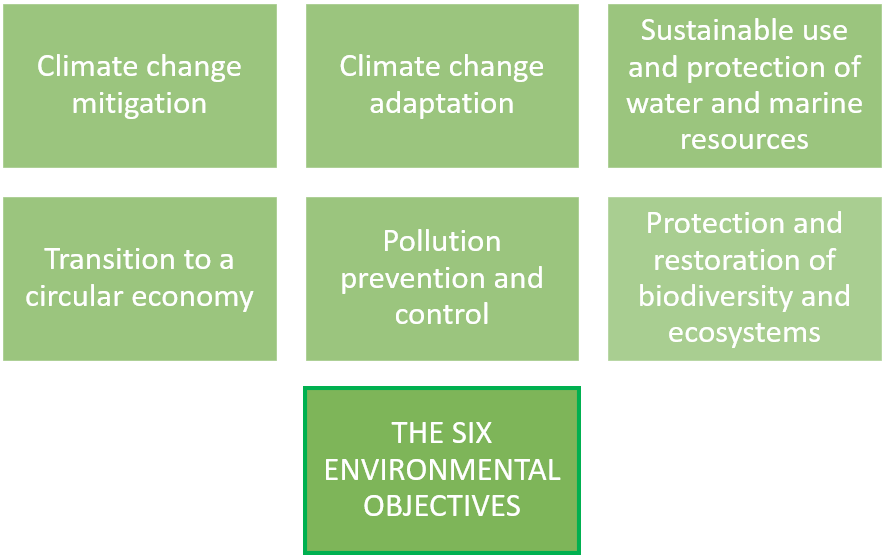

These criteria thus focus mainly on six environmental objectives defined in the Taxonomy Regulation.

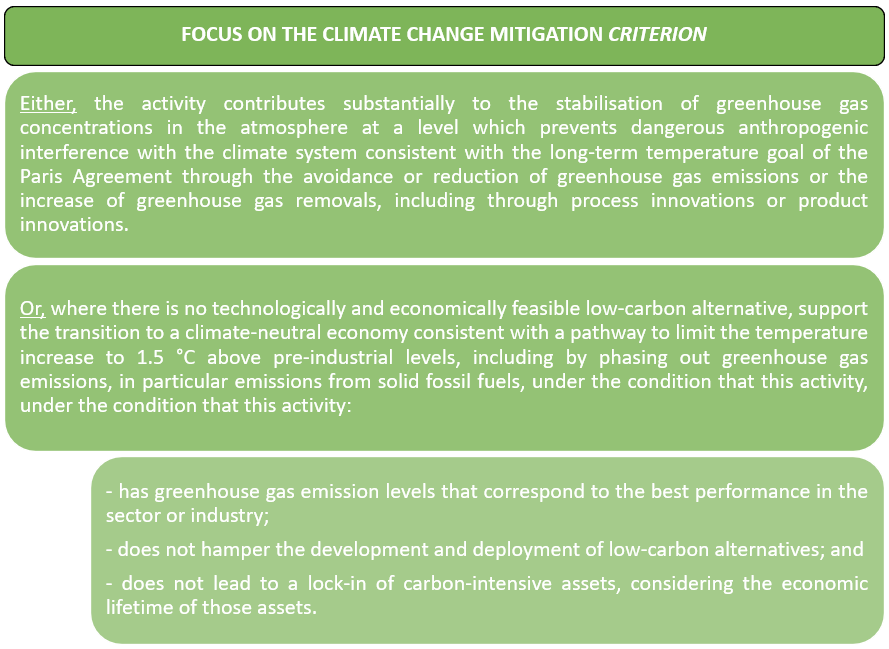

Among the three sets of criteria, a major point of debate is the climate change mitigation objective.

The first two climate delegated regulations of the European Commission

A first delegated regulation was adopted by the EC on 4th June 2021, in force as from 1 January 2022. It aims at defining activities contributing substantially to at least one of the two first environmental objectives, and not harming significantly the others.

Its annex I defines activities complying with the climate change mitigation objective while not significantly harming the five others. These activities contribute to the fight against climate change.

Its annex II defines activities complying with the climate change adaptation objective while not significantly harming the five others. This concerns the adaptation of activities to the current or expected adversarial effects that climate change has or may have on these activities.

The first act was supplemented by a second delegated regulation of the EC adopted on 6 July 2021 which enforcement is progressive over the years, starting on 1 January 2022 for the first set of provisions. This second act relates to the disclosure of information by various financial and non-financial undertakings.

The second section of the paper may be found here.

Back to articles